The latest performance data for Google Ads campaigns running Performance Max (PMax) in Q3 2023 vs. Q3 2024 paints a mixed picture, according to an Optmyzr study. While advertisers saw modest year-over-year gains in return on ad spend (ROAS) and conversion rates, rising costs cut into those improvements.

The key metrics.

ROAS: Up 1% YoY, from 609.77% in Q3 2023 to 616.36% in Q3 2024

CPA: Up 8% YoY, from $13.92 in Q3 2023 to $15.15 in Q3 2024

CPC: Up 6% YoY, from $0.50 in Q3 2023 to $0.53 in Q3 2024

Conversion Rate: Down 3% YoY, from 3.56% in Q3 2023 to 3.47% in Q3 2024

The data suggests PMax is delivering modest ROAS improvements, but rising CPAs and CPCs are eating into those gains. Conversion rates also slipped year-over-year.

When breaking down the data by campaign type, a more nuanced picture emerges.

Search campaigns:

ROAS up 2% YoY

CPA down 3% YoY

CPC up 22% YoY

Conversion rate up 21% YoY

Shopping campaigns with PMax:

ROAS up 4% YoY

CPA down 15% YoY

CPC down 10% YoY

Conversion rate up 5% YoY

Shopping campaigns without PMax:

ROAS up 13% YoY

CPA down 3% YoY

CPC down 10% YoY

Conversion rate down 7% YoY

PMax is helping drive ROAS and conversion rate improvements for shopping campaigns, but search campaigns are seeing the biggest conversion rate gains, the data suggests. Meanwhile, shopping campaigns without PMax are delivering the highest ROAS.

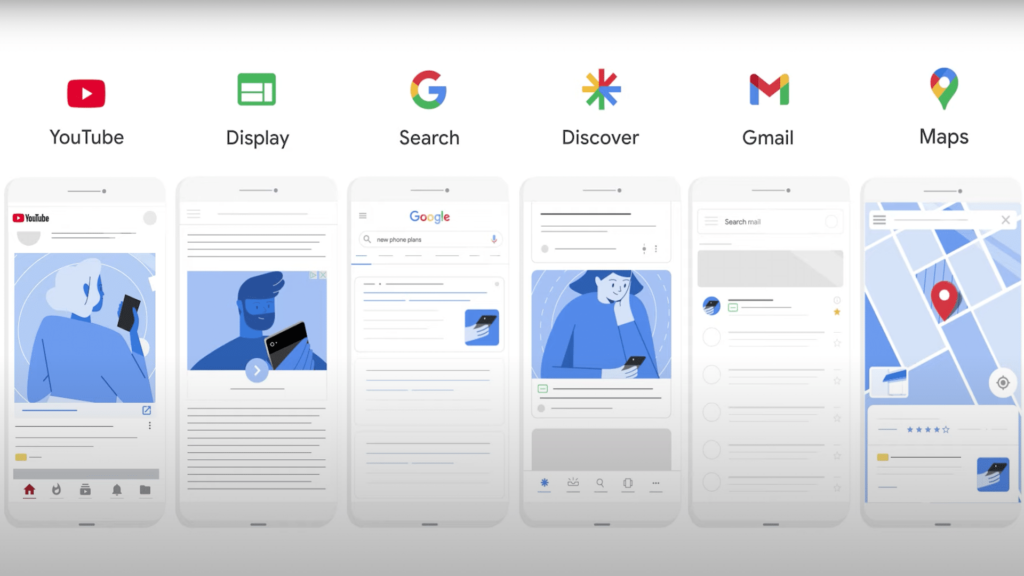

What they are saying. “PMax CPCs are about 50% cheaper than search because they factor in visual content,” said Optmyzr Brand Evangelist Navah Hopkins, who shared the data on LinkedIn. She advised investing in visual creative:

“If you’re struggling with the cost of search, visual content tends to be cheaper and can deliver meaningful ROAS and decent CPAs if you layer in great creative and accurate conversion tracking + values.”

Impression share effect. One concerning trend is the growing impact of impression share loss, which could limit the overall effectiveness of these campaigns. Across search and shopping, impression share loss was higher for PMax campaigns compared to non-PMax.

Bottom line. While PMax continues to show modest improvements, rising costs and impression share loss risks eroding those gains. Advertisers may need to closely evaluate the tradeoffs and find the right balance of PMax and other campaign types to optimize performance.